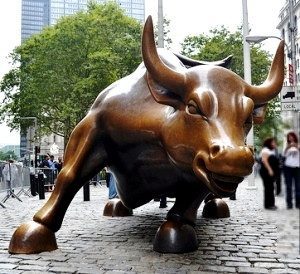

Posted in Corporate Law

Malik was convicted in December by a jury after a two week trial in New York County Supreme Court of 28 counts charged in the state Attorney General’s indictment, including grand larceny and securities fraud, according to a press release issued by the Attorney General’s office.

Malik invented a number of fictitious hedge funds which he claimed routinely outperformed the market by over 200%. From 2011 to early 2015 he convinced investors that he managed multi-million dollar hedge funds that earned high returns. Malik,

- Advertised his hedge funds on his own website and on the internet.

- Also scammed money the old fashioned way by making cold calls to possible investors/victims.

- Admitted during the trial he solicited dozens of investors in the United States and abroad.

- Convinced at least seventeen people to invest more than $800,000 in his hedge funds which was actually spent to support his lifestyle with $215,000 in cash withdrawals from accounts and an additional $210,000 spent on hotels, airline tickets, rental cars, restaurants, electronics, utilities and a karaoke bar.

Publicity for these fictional funds helped Malik.

- The supposed success of Seven Sages Capital, L.P. and American Bridge Investments L.P. was posted on financial websites including Bloomberg and Barclay Hedge.

- Barclay Hedge awarded American Bridge Investments L.P. in 2012 the “yearly performance award” ranking it as the year’s top performing equity long-short fund with over $100 million in assets.

- The ranking was based on false documents submitted by Malik including a forged financial audit.

- Instead of having millions in assets under management as he claimed his brokerage accounts never held more than $90,000.

Malik was a very busy guy. His bona fide Wall Street experience was as a trainee at a financial consulting firm and he was registered as a broker from 2007-2009. While running his scam Malik actually worked as a security guard, waiter and traffic agent. While balancing all these duties he,

- Promised a partnership interest in his hedge funds to potential investors, which he claimed contained millions of dollars-worth of various investments in high-profile IPO’s and secured bond transactions.

- Created false offering memoranda and marketing material claiming his hedge funds had over $100 million in assets.

- Fabricated account earnings statements which claimed that investments consistently earned profits.

Malik is also facing civil claims filed by the Securities & Exchange Commission last February according to CNN/Money. An investor cited in that complaint claims Malik faked his own death, creating a fictional employee who informed the investor through email Malik had died of a heart attack.

If you believe you are the victim of investment fraud it’s time to take action. Don’t let embarrassment stand in the way of holding the con man accountable. Contact our office today so we can talk about the situation, what laws may apply and how you may be able to get at least some of your investment back. The longer you delay the more difficult it may be to recoup your losses.